To help you understand your rates notice, we've put together a sample rates notice.

This example has been prepared as a guide only, the information and figures may not be a true reflection of a current rates notice.

To help you understand your rates notice, we've put together a sample rates notice.

This example has been prepared as a guide only, the information and figures may not be a true reflection of a current rates notice.

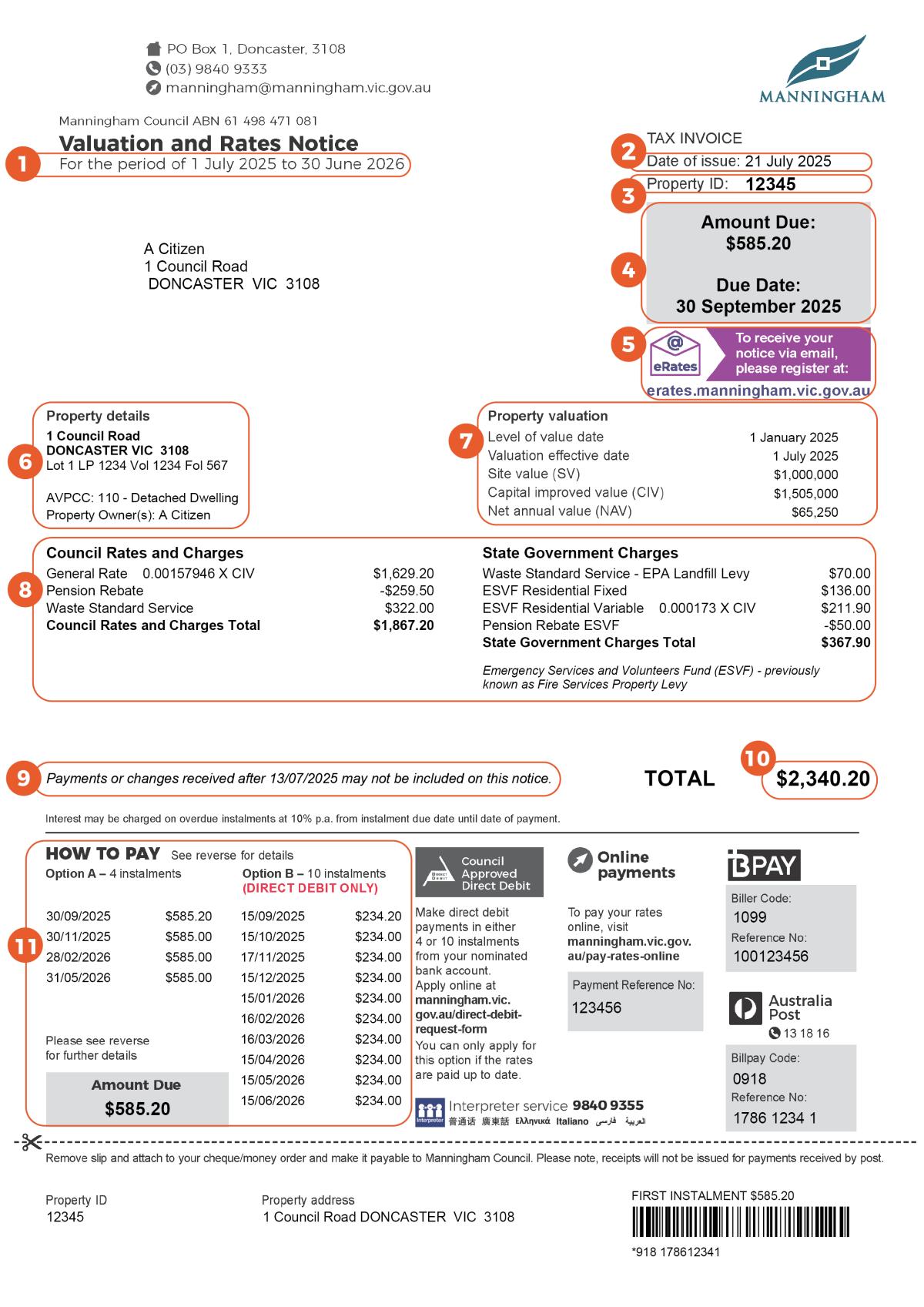

The period relating to this notice, effective from 1 July to 30 June each year.

This is the date that the notice was printed and issued.

Council’s identification of your property. Please have this handy when making enquiries regarding your rates notice or completing online forms.

Provides the first instalment amount with the due date. If you are on Direct Debit, or have an arrangement with Council, this will be noted in this section. If you are on Direct Debit, Council will debit your payment.

If you would like to receive your notices via email, register online.

This section has your property address, title particulars, the Australian Valuation Property Classification Code (AVPCC) and the owner's details. The AVPCC is assigned to your property according to the use of your land.

If you have made any changes or payments that were received by Council after this date, they may not be shown on this rates notice.

This is the total amount due on your account (including any arrears). If you have any arrears, please pay the arrears amount immediately.

Your rates and charges amount due in instalments by the respective dates.